Debt Management Plan (DMP)

- One affordable monthly payment

- Flexible payments

- We deal with your creditors

- Take control of your finances

May not be suitable in all circumstances. Fees apply. Your credit rating may be affected.

MoneyHelper is a Government-backed service that gives guidance on a range of money matters.

What We Offer

One Affordable Monthly Payment

Consolidate all your unsecured credit into one affordable monthly payment.

Check If I Qualify

Flexible Payments

DMPs are flexible so if your circumstances change, the payments change to ensure the plan is affordable.

Check If I Qualify

We handle all communications with creditors on your behalf to take the stress away from you.

Check If I Qualify

Debt Management Plans (DMP)

Take Back Control at a Pace You Can Afford

A Debt Management Plan (DMP) is an informal, flexible, and confidential way to deal with debt. It lets you combine your unsecured debts into one monthly payment you can afford, so you can keep on top of essentials like rent, food, and bills. At Dexter Bell, we’re FCA-regulated, which means we act in your best interests. We deal with your creditors on your behalf, asking them to accept reduced payments and freeze interest and charges. This takes the pressure off you.

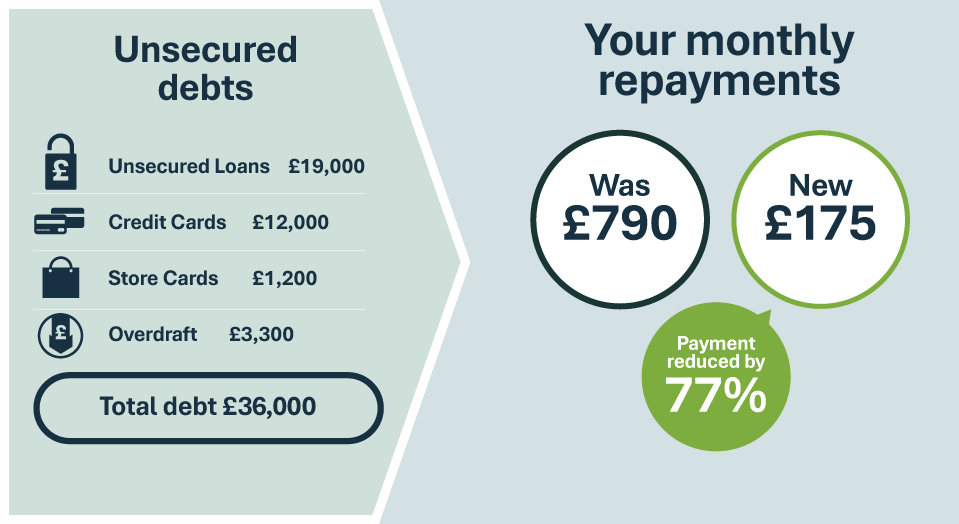

Actual example of Dexter Bell client Sally, October 2024

You don’t have to face debt alone.

We’re here to help you take back control quickly and without judgment.

What are the pros and cons of a DMP?

Pros

- One affordable monthly payment

- Flexibility - payments can go up or down if your finances change

- Creditors often freeze interest and charges

- Less stress – we deal with creditors for you

- Take control of your finances

Cons

- Not legally binding – creditors don’t have to agree (though most do)

- It can take longer to clear debts if you pay less each month

- Your credit score will be affected, and defaults may appear

- Not all debts can be included (e.g. rent, secured loans, council tax)

What debts can be included in a DMP?

You can include most unsecured debts:

- Credit cards

- Loans and overdrafts

- Store cards

- Payday loans

- Catalogue accounts

- Old utility or phone bills

You cannot include:

- Rent or mortgage

- Secured loans

- Council tax

- Current utility/household bills

- Insurance policies you still need

How much does a DMP cost with Dexter Bell?

We are upfront about the cost. Our fees for setting up and managing your plan are taken from your agreed monthly payment so there is nothing extra to pay.

Setup Fee: £135, spread over your first 18 months so it’s manageable. This fee covers: creating DMP proposal and negotiating reduced repayment agreements with each of your creditors.

Ongoing Management Fee: £42 for managing your plan. This fee covers: dealing with your creditors for you, calculating and distributing your payments, annual reviews and providing ongoing support.

For example, if you owe £8,000 and pay £250 per month:

- In the first 18 months, £200.50 goes to creditors, £42 for management fee, and £7.50 for setup fee.

- From month 19, £208 goes to creditors, £42 for management fee.

- Duration of DMP would be 39 months.

Is a DMP Right for You?

Will a DMP affect my credit rating?

Yes. Because you’re paying less than originally agreed, your creditors are likely to issue defaults. These stay on your file for six years. But remember: if you’re already struggling, missed payments may already be on your file. A DMP can help stop things getting worse and start putting you back in control.

What happens if my circumstances change?

Life happens! DMPs are flexible. If your income goes up or down, we can adjust your payment so that it is always affordable for you. We’ll review your situation regularly to keep things realistic.

Is a DMP right for me?

A DMP could work if:

- You owe at least £2,000 in unsecured debts

- You can afford at least £100/month

- You want a flexible, non-legal solution

- You’d value someone negotiating with creditors for you

It may not be right if:

- You have high debts and low income (a DRO or IVA might be better)

- You own significant assets (your own home for example) you want to protect

- You want debt written off more quickly

We’ll always go through all your options, so you know what’s best for you.

Get In Touch

Have a question or feedback?

Fill out the form below, and we’ll respond as soon as possible.

Call us at 0161 802 3102 or fill out our form, and we’ll contact you as soon as possible.