Individual Voluntary Arrangement (IVA)

- Write off up to 80% of your debt*

- One affordable monthly payment

- Fixed term agreement of usually 5 years

- Legal protection from your creditors

*May not be suitable for all. Write off based on individual circumstances. Also may not be suitable in all circumstances. Fees apply. Your credit rating may be affected.

MoneyHelper is a Government-backed service that gives guidance on a range of money matters.

What We Offer

Write off up to 80% of your debt*

At the end of the IVA term the remainder of the debt is written off.

Check If I Qualify

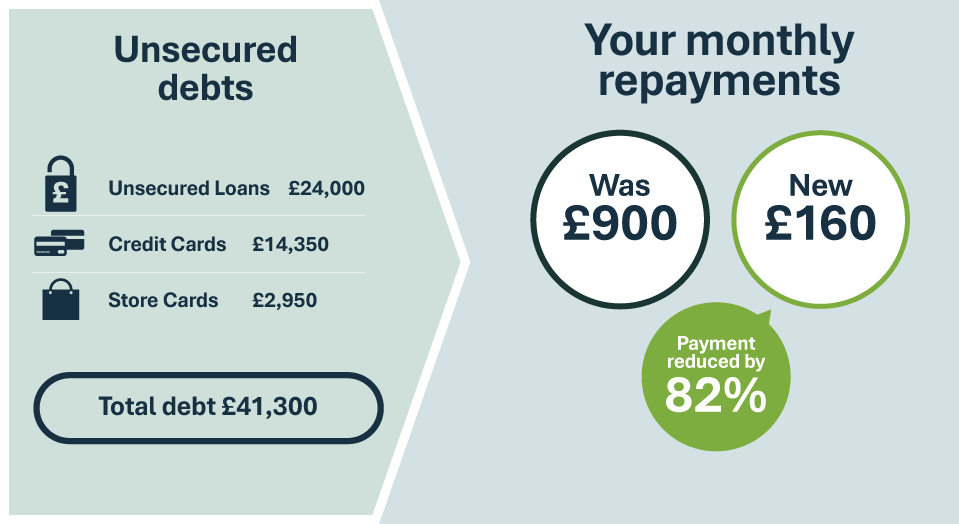

One affordable monthly payment

Consolidate all your unsecured credit into one affordable monthly payment.

Check If I Qualify

You will pay an amount that you can afford over a fixed period, usually 5 years.

Check If I Qualify

Individual Voluntary Arrangements (IVA)

A structured way to deal with debt

An Individual Voluntary Arrangement (IVA) is a formal, legally binding agreement between you and your creditors. It supervised by a licensed insolvency practitioner which allows you to repay what you can afford towards your unsecured debts over a realistic time frame (usually 5-6 years).

At the end, any remaining qualifying debt is written off. Payments are based on what you can afford, not what creditors demand. Once in place, creditors can’t add interest, take legal action, or chase you directly.

How does an IVA work?

- We check if you qualify – IVAs are usually suitable if you owe more than £7,000 in unsecured debts and can make regular payments.

- We help prepare your proposal – This sets out your income, essential spending, and what you can realistically pay.

- Creditors vote – If creditors holding 75% of your debt agree, the IVA becomes legally binding on all.

- You make one monthly payment – The Insolvency Practitioner distributes this to creditors.

- At the end – Any unpaid qualifying debt is written off.

Actual example of Dexter Bell client – David, March 2023

What are the pros and cons of an IVA?

Pros

- One affordable monthly payment instead of juggling several

- Remaining debts written off at the end of the IVA

- Interest and charges are frozen

- Creditors cannot chase or take legal action against you

Cons

- Legally binding – you must stick to the agreement

- Failing an IVA could lead to bankruptcy

- Appears on the public Insolvency Register

- Cannot borrow more than £500 without permission during the IVA

- Your credit history will be affected for at least six years

Will an IVA affect my credit rating?

Yes. Entering an IVA will appear on your credit file for six years and will also be listed on the public Insolvency Register. This can make it harder to get credit, a mortgage, or even some tenancies during and shortly after the IVA. However, many people see their credit score begin to recover once the IVA is completed.

What debts can I include in an IVA?

IVAs can cover most unsecured debts, such as:

- Loans & credit cards

- Overdrafts

- Payday loans

- Catalogue accounts

- Old utility bills

You cannot include:

- Student loans

- Court fines

- Child maintenance arrears

- Some secured loans or mortgages

How much does an IVA cost with Dexter Bell?

You don’t pay IVA fees upfront. All fees are taken from your monthly payments. These include:

- Nominee’s fee – for setting up your IVA and preparing the proposal to creditors.

- Supervisor’s fee – for running and managing the IVA through its term.

The exact fees are set out in your IVA proposal and must be agreed by your creditors. Importantly, they are included in your monthly contribution, so you don’t have to pay them separately.

Is an IVA Right for You?

An IVA could be suitable if you:

- Owe more than £7,000 in unsecured debts

- Have a steady income and can make regular payments

- Need protection from creditors and legal action

- Want a clear end date to your debts

It may not be right if:

- Your income is low or unpredictable

- You’re unable to commit to regular payments

- You have high levels of assets

- Your employment contract doesn’t allow it

We’ll always explore every option with you before recommending an IVA.

Get In Touch

Have a question or feedback?

Fill out the form below, and we’ll respond as soon as possible.

Call us at 0161 802 3102 or fill out our form, and we’ll contact you as soon as possible.